Affordable Insurance can help make your time on the water relaxed and worry-free! We will find you comprehensive protection that protects you, your friends and family, your watercraft and your boating equipment. The average boat costs less than a dollar a day to insure. You’ll enjoy being on the water even more when you aren’t worried about your safety, the safety your passengers, or your investment.

Arkansas – Do you know what to look for in a watercraft insurance policy? Affordable Insurance can help you determine the right amount of coverage to meet your specific needs. Just give us a call today at 870-425-6079to get started. Here are some items you’ll need to consider when shopping for boat insurance in Arkansas.

- Navigational Area:

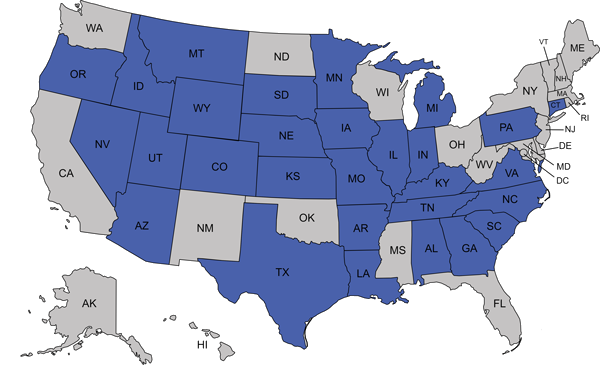

Know where you are covered in the water. Some companies, such as Safeco Insurance, offer protection that covers you up to 75 miles from the U.S. coastline; into Canadian coastal or inland waters; and into the Pacific coastal waters of Mexico. In California, Florida and Oregon, additional coverage area can be purchased.

- Agreed Value Coverage:

Watercrafts depreciate just like automobiles. Actual cash value policies can make it difficult to replace a boat that’s been stolen or destroyed. This means that if your boat is a total loss you will get the value you insured it for, minus any deductible.

Like car insurance, personal liability coverage provides coverage to other boaters and boat owners in the event you are at-fault for an accident on the water. This coverage will pay to repair or replace the property of someone else as well as for their medical care, lost wages and other costs incurred as a result of a boating accident for which you are at-fault.

Medical payments coverage will pay for the cost of needed care that is the result of a boating accident. This coverage is available from $500 to $10,000 and covers you, your passengers, and even your water skiers/tubers, regardless of who is at-fault.

Physical damage coverage pays for the cost to repair or replace your watercraft, its motor, any permanently attached equipment, and your trailer, if it is stolen or damaged.

- Uninsured/Underinsured Watercraft Bodily Injury

Since boat coverage is not always mandatory, many boaters choose not to get insurance. If you are hit by an uninsured or underinsured boater, and you are injured, this type of coverage pays for medical treatment, lost wages, and other costs associated with the accident.

- Fuel Spill Liability and Wreckage Removal

Should your boat sink or be seriously damaged, there is a chance that it could leak oil or fuel into the water. As the boat’s owner you are required by law to have this cleaned up, which can be time consuming and expensive.

Your policy can provide coverage for many personal effects, including clothing, jewelry, cell phones, scuba/snorkeling and other sporting equipment, and fishing equipment. Limits vary by state – check with

Affordable Insurance for information. Personal effects coverage does not include jewelry, watches or furs.

- Unattached Equipment Coverage

This pays to repair or replace equipment that isn’t permanently attached to your boat or personal watercraft, but is designed for use primarily on a boat. This includes items like lifesaving equipment, water skis, anchors, oars, fire extinguishers, tarps etc.

The Emergency Assistance Package provides coverage for towing, labor and delivery of gas, oil or loaned battery if the watercraft is disabled while on the water.

Every need is unique – contact Affordable Insurance today Call 870-425-6079 to find out how to get the best boat and watercraft insurance coverage for you.