Is the Life Insurance My Employer Provides Enough?

Did the latest case of an injury or illness that affected you or your loved one compel you to make some out-of-pocket payments after your employer’s insurance coverage hit the limit? If so, then it’s time to supplement your employer’s insurance policy with an individual insurance policy.

Virtually all employers provide their employees with a group term life insurance that covers all their staff. The insurance coverage is a good perk for employees, and it can be a life-saving benefit package for employees with no life insurance. But such insurance coverage often has a limit, and you never know whether you’’ have any cash to make out-of-pocket payments when your medical bills go beyond the set cap. It’s prudent to determine whether the coverage is sufficient because an insufficient policy may put your family at risk if the worst happens.

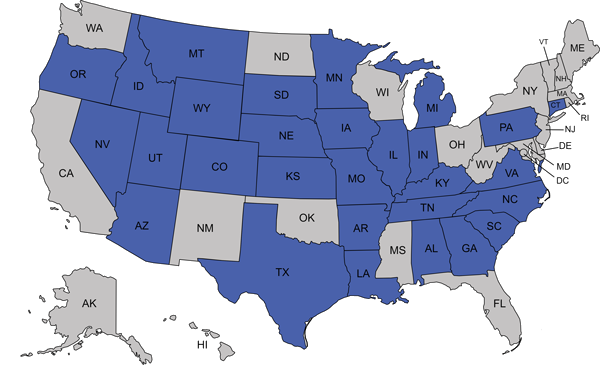

Here are the top three reasons why Mountain Home, AR residents should get an individual insurance policy from Affordable Insurance Inc. even when they’re under an employer’s group term life insurance.

Job Loss

It’s possible to lose your job because of severe long-term illness, impairment, or going against the company’s set rules, regulations, and laws of the state. If you lose your job, you also lose your insurance coverage, which means your family will be at risk, and you’ll need to find alternative coverage.

Death

If you die, your employer’s insurance coverage may cease to protect your spouse and kids. But if you had individual coverage, your spouse may continue paying the premiums and still benefit from your supplementing personal insurance.

Your Employer’s Insurance Cover May be Inadequate

Some insurance professionals recommend that your insurance should be worth at least 10 to 12 times your monthly earnings to be sufficient. This estimation may or may not be accurate. But you can talk to any insurance company to get advice on whether you’ll need to get a personal policy if the employer’s cover isn’t sufficient.

If you’re a Mountain Home, AR resident who’s seeking a supplemental personal insurance policy, then it’s time to contact Affordable Insurance Inc. to get reliable quotes today!