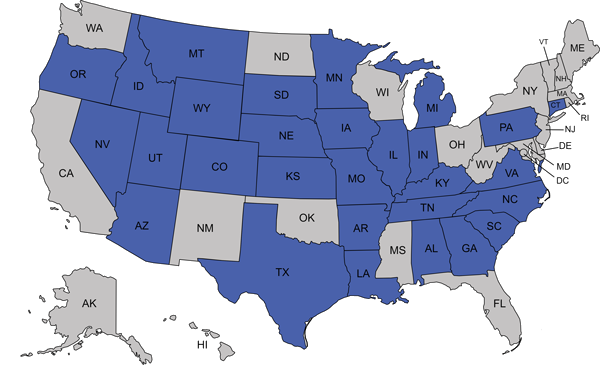

Benefits of Life Insurance in Mountain Home, AR

With life insurance, there are a lot of benefits to be had in Mountain Home, AR. Whether you’re looking for coverage for yourself or your family, some policies can fit your needs.

Here are some benefits of life insurance:

1) Protection From Financial Hardship

If something happens to you and you have no life insurance, your loved ones may experience financial hardship. With the money from a life insurance policy, they can cover your funeral costs and any other expenses. This can help them avoid going into debt or struggling to make ends meet.

2) Peace of Mind

You can rest easy knowing that you and your loved ones are taken care of financially if something happens to you when you have life insurance. This peace of mind can be priceless. Consider that you can’t put a price tag on knowing it takes care of your family if something happens to you.

3) Retirement Planning

Many people use life insurance as part of their retirement planning. If you have a life insurance policy with a significant death benefit, you can use it to help fund your retirement. This can be a big help, especially if you don’t have saved up a lot.

4) Estate Planning

Another use for life insurance is in estate planning. If you have a life insurance policy with a significant death benefit, you can use it to help pay for your funeral costs and other estate expenses. This can be a big help for your loved ones. An Affordable Insurance Inc agent can work with you to find the right life insurance policy for your needs.

There are many benefits to having life insurance in Mountain Home, AR. If you’re looking for coverage, be sure to talk to an Affordable Insurance Inc agent. They can help you find the right policy for your needs. Call today!