Home Insurance and Vandalism

People can sometimes act in ways that are inconsiderate or harmful. Unfortunately, this can include acts of vandalism, such as throwing a brick through a window, spray-painting offensive messages on a front door, or even egging a house on Devil’s Night. Other times, damage may occur unintentionally, like cutting down a tree on your property or accidentally backing over your fence. Regardless of the cause, the financial burden of repairing such damages is often covered by your home insurance policy.

Does Home Insurance Cover Vandalism?

In most cases, vandalism is covered under your home insurance policy through dwelling coverage. This type of coverage pays for repairs to your home’s structures, including attached features like garages. If the damage involves a detached structure, such as a fence or shed, the repairs are typically covered under the coverage for other structures. Personal belongings damaged or stolen during an act of vandalism are also protected under personal property coverage. Be sure to review your policy to understand your coverage limits. Items like jewelry or firearms may have specific sublimits due to their higher risk of theft.

If you operate a business from your home, consider adding a business property endorsement to your policy, as standard home insurance may not cover business-related items. Additionally, if your home is unoccupied for more than 60 days, your coverage may lapse. To ensure protection during extended absences, you can add a vacant home endorsement to your policy.

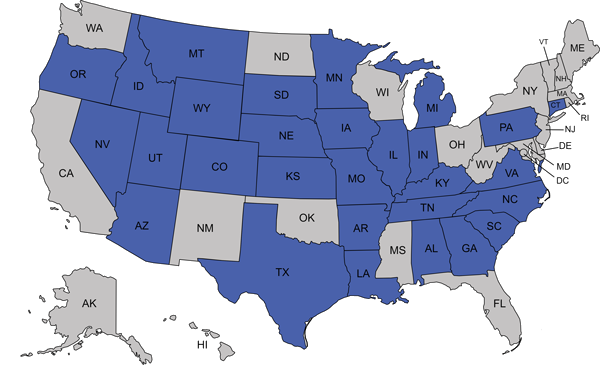

Contact Affordable Insurance in Mountain Home, AR

If you live in the Mountain Home, AR area and need a reliable home insurance policy, contact Affordable Insurance Inc. Our team is here to assist you with finding the right coverage for your needs.