Does Your Etsy Store Need Commercial Insurance?

When your Etsy business is booming, it can be tough to keep up! With that in mind, it’s crucial to ensure that you’re protected if something goes wrong. In this article, we’ll explore what you need to consider when deciding whether your Etsy business needs commercial insurance.

Is Commercial Insurance Legally Required for Etsy Businesses?

Understanding the type of coverage your small business needs can be challenging. While commercial insurance for an Etsy business is not legally required, it can be highly beneficial for several reasons, including:

- Product liability: A commercial insurance plan can offer protection if a customer claims that your product caused damage or injury.

- Property damage: Many Etsy businesses operate from home. In this case, commercial insurance can protect you against damage to your inventory or equipment.

- Professional liability: If you offer customized products on your Etsy store, a commercial insurance plan can offer protection if a customer claims that you provided inadequate service.

- Business interruption: Life is unpredictable. If an unexpected event forces your business to slow down or halt entirely, business interruption insurance (included in your commercial insurance plan) can help cover lost income.

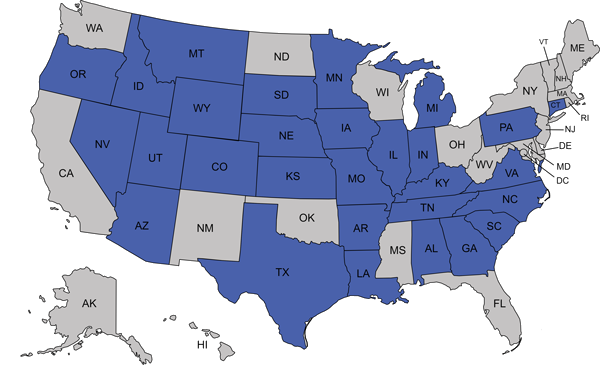

Reach Out to Affordable Insurance Inc, Serving Mountain Home, AR, To Learn More

At Affordable Insurance Inc., we take pride in serving the residents of Mountain Home, AR. We’ll guide you every step of the way as you choose the insurance products that best fit your business needs. Contact our team today to find out more.