Purchasing the homeowners insurance that is right for you and your home can be confusing, especially for first-time buyers. By learning the basics on how to get the most for your money, you can save on your homeowners insurance and feel confident you have adequate coverage. Affordable Insurance, a leading provider of homeowners and auto insurance, offer these tips to lead you in the right direction when you purchase your homeowners insurance.

- Raise your deductible. Companies generally have deductibles (what you pay before your insurance policy kicks in) starting at $500. By choosing a higher deductible ($750,

$1,000, $2500 or higher), you’ll have lower annual premium payments.

- Consider how much insuring a new home will be. The age of your home may qualify you for savings because plumbing, heating and electrical systems of newer homes have lower risks than outdated systems. Construction of the home (brick versus wooden frame) can affect your cost as well, depending on your home’s location. Also, if you live near your local fire department, your homeowners rates might be lower than if you are many miles away.

- Insure your home, not your land. Since homeowners policies don’t provide protection for your land, it would be a waste of money to include its value as part of your dwelling coverage, which should only reflect the price it would cost to repair or replace your home’s structure.

- Insure your car and home with the same company. You can save money if you have more than one type of policy with the same insurance company. The more good business you give the company, the more valuable you are as a

- Improve home security and safety. If your home has certain types of fire alarms, burglar alarms, locks, or smoke detectors, you’ve reduced your risk and may qualify for a

- Look for senior discounts. If you are at least 55 years old and retired, your insurance company may offer you a discount. Retirees often spend more time at home and are more likely to spot trouble and prevent a

- Stay with one insurer. If you keep your coverage under one insurer for several years, you may be offered a discount from the company. The longer you are a customer, the more money you will likely end up

- Compare the limits in your policy to the value of your possessions at least once a year. If you make any major purchases or additions, you want to ensure they will be covered, but you do not want to spend more than is

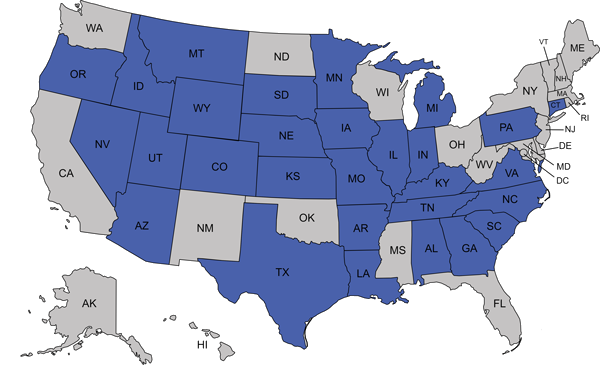

Established in 1995, Affordable Insurance is an independent insurance agency offering a full range of insurance products including AUTO, HOME, LIFE, HEALTH, BUSINESS.

For information and quotes on insurance coverage, please visit Affordable Insurance at one of our locations 635 Hwy 62 East Mountain Home, Arkansas; 816 East Main Street Flippin, Arkansas; 324 Highway 62 65 North Harrison, Arkansas or call 870-425-6079.