How Motorcycle Insurance Works

Motorcycles are amazing vehicles to ride, but they do come with their own risks. You can protect your motorcycle against many of these risks with a motorcycle insurance policy. To get your ride covered, call us at Affordable Insurance Inc in Mountain Home, AR.

Liability Coverage

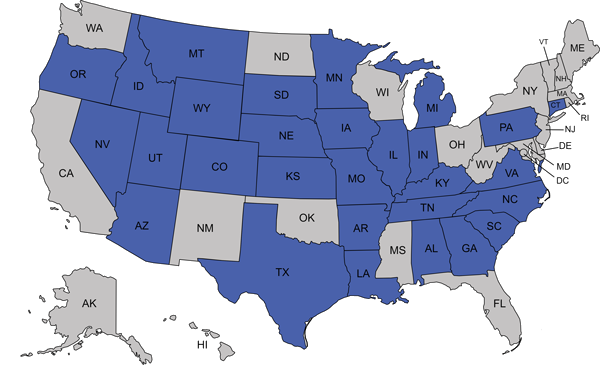

As with auto insurance, motorcycle insurance comes in a number of coverage types. Liability coverage includes both bodily injury liability and property damage liability. If you were to cause an accident to another party with your motorcycle, your liability coverage would pay for the resulting bills up until your policy’s maximum is reached. This is an incredibly important insurance to have, as it protects you against lawsuits filed against you and other financial problems. It is also required to have both bodily injury liability and property damage liability coverage for motorcycles in Arkansas.

Comprehensive and Collision Insurance

You can also choose to get comprehensive insurance, which covers the bike for damage and loss that is not due to a collision. Many different risks are included in this coverage, and it can help you to get back on the road faster after an incident that causes motorcycle loss or damage. There is also collision insurance. This covers the damage to your motorcycle if there is an accident that is your fault. It can also include bodily injury coverage, which pays for your resulting medical bills after an accident. You can also choose to get coverage for underinsured and uninsured motorists who cause an accident with your bike.

Get Your Motorcycle Policy

Don’t drive your motorcycle without having the appropriate coverage for it, including the minimums required by the state. To find out more about motorcycle coverage, give us a call today at Affordable Insurance Inc in Mountain Home, AR to talk with an insurance agent.