Is flood insurance in Arkansas always a good investment?

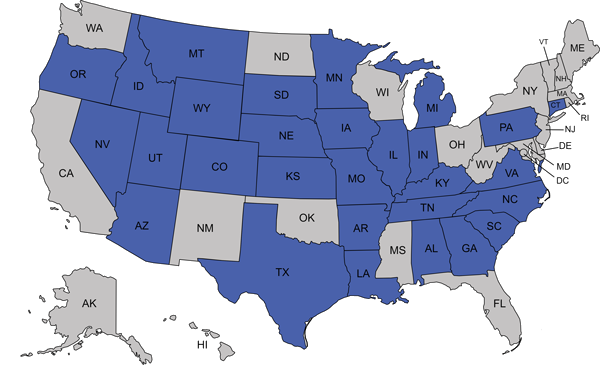

When you are a Mountain Home, AR area resident, you should always think about owning and purchasing your own home. As you are looking for a new home here, ensuring that you have the right insurance continues to be very important. One form of insurance that you should always consider getting is flood insurance. This type of insurance is a good investment in many situations.

When Trying to Protect Home

When having flood insurance is a good investment, one situation is when you are trying to protect your home. Those who live in Arkansas may be concerned about the risk of flood due to local rivers and lakes. If you are concerned about the risk of floods near your home, having flood insurance is a good option as it will offer the financial resources needed to cover any repairs that you have.

When Trying to Comply with Requirements

It would be best if you also considered getting flood insurance when you want to stay in good standing with your lender. If your home is in a flood zone, your mortgage lender will require that you get proper insurance to protect it. If you do not have this coverage, you could violate the loan agreement and face penalization.

If you would like to get a flood insurance plan in the Mountain Home, AR area, it would be wise to speak with Affordable Insurance Inc. There are a lot of important factors to take into consideration, and the team with Affordable Insurance Inc can help you choose a plan that is right for your situation. This will help ensure that your home is properly protected with insurance and that you stay in full compliance with your insurance obligations.